Why international property buyers may wish for Brexit to happen

- Because house prices have DOUBLED in just 7 years in London – and Brexit could counter that to some extent

The growth in housing prices in London since 2007 is nothing short of amazing.

According to Tom Bill, Knight Frank’s head of London residential research, Hackney has been the top performing London borough with prices soaring by an unbelievable 126 % !

This is not an isolated case. As you can see below, in most neighborhoods, the prices have simply doubled[1] :

Top 15 boroughs for price growth – March 2009 to January 2016

- Hackney, 126 per cent

- Lambeth, 104.4 per cent

- City Of Westminster, 104.4 per cent

- Southwark, 101.9 per cent

- Richmond Upon Thames, 100.5 per cent

- Kensington And Chelsea, 99 per cent

- Hammersmith And Fulham, 94.9 per cent

- Waltham Forest, 94.7 per cent

- Wandsworth, 94.5 per cent

- Camden, 94.2 per cent

- Merton, 91.6 per cent

- Lewisham. 85.6 per cent

- Islington, 84.7 per cent

- Haringey, 82.1 per cent

- Greenwich, 82 per cent

2) Because Brexit would mean bargains !

The Head of Europe, Middle East and Asia for JLL, Guy Graigner, recently summarized it well for the Telegraph[2], saying that :

« This is the big irony of the leave campaign – which is anti any foreign influence. In the event of a Brexit we may see a price correction in property and a fall in sterling which opportunistic international investors will view as a chance to pile in ».

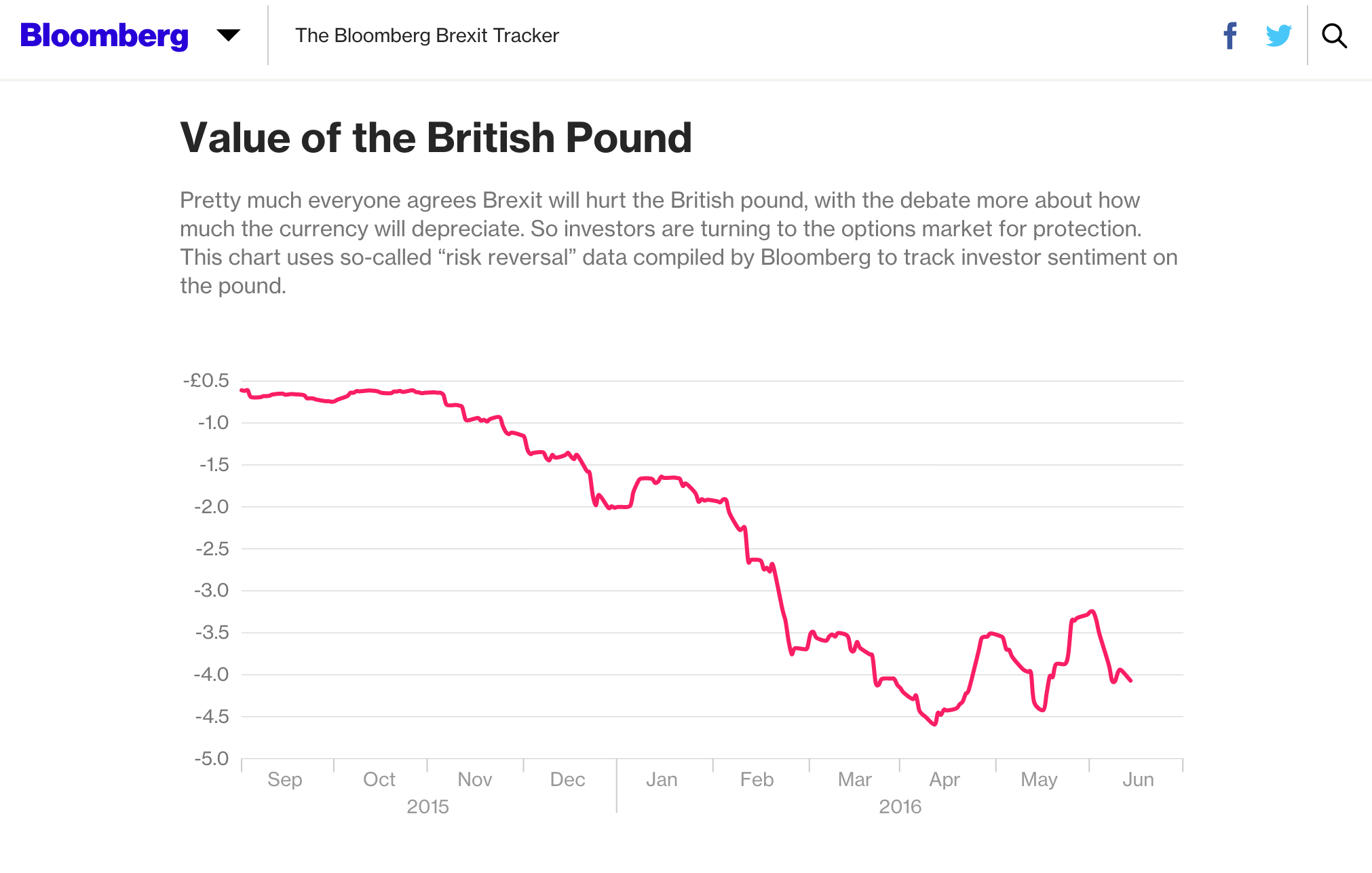

According to HSBC, Brexit could wipe 20% off the pound [3]!

Let’s summarize : + 100% in 1 year, and maybe a 20% « discount » coming on June 23. Well, here is why international buyers are being quiet, right ?

Why are international buyers being so quiet these days in London ?

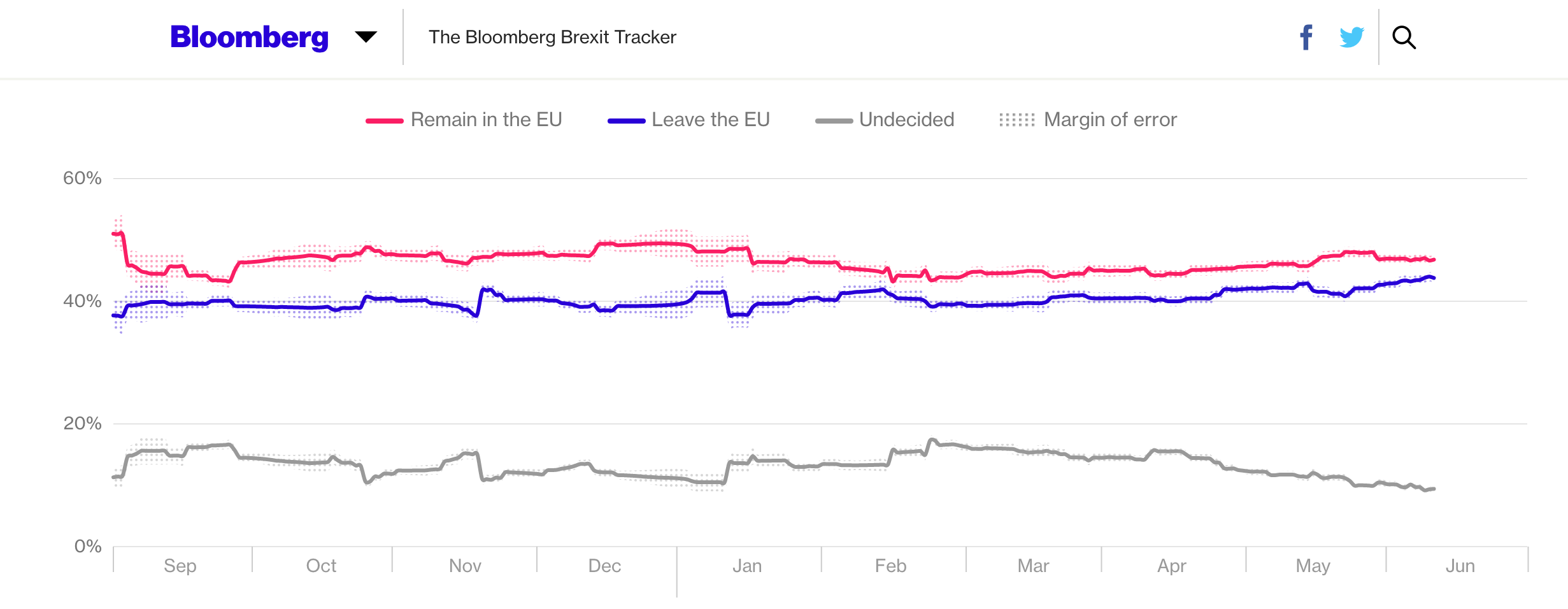

Well, the very serious Bloomberg Brexit Watch[4] shows how unsure the outcome of the vote that will be held on Thursday 23 June[5] is ! Just have a look below at how close the polls are :

Foreign investors are therefore waiting to see whether Brexit happens or not. If Brexit were to happen, it could bring prices down as the Pound could experience a sharp decline as experts have warned, which could be as much as 20% according to HSBC[6].

With prices doubling in 7 years, investors can wait 10 more days, to seize the opportunity that a decline in the pound could represent.

Meanwhile, many international investors, and many real estate vendors in southern Europe fear Brexit

A Brexit would definitely not be good news for Spanish, Portuguese, French agencies who are used to selling to UK Buyers. A weakening Pound would also mean a lower purchasing power for them, responsible for 15,800 transactions [7]a year in Spain and 3,200 transactions [8]a year in Portugal for example.

Therefore role of UK as both a European, and International seller and buyer of real estate could definitely be affected in case Brexit happens, on June 23rd.

[1] http://www.express.co.uk/finance/city/661109/Property-crash-fears-as-London-loses-its-lure-for-foreign-buyers

[2] http://www.telegraph.co.uk/property/commercial/the-big-brexit-irony-foreign-property-buyers-will-pile-into-the/

[3] https://www.theguardian.com/business/2016/feb/24/brexit-could-wipe-20-percent-off-the-pound-warns-hsbc

[4] http://www.bloomberg.com/graphics/2016-brexit-watch/

[5] http://www.bbc.com/news/uk-politics-32810887

[6] https://www.theguardian.com/business/2016/feb/24/brexit-could-wipe-20-percent-off-the-pound-warns-hsbc

[7] https://foreignbuyerswatch.com/2016/05/19/spain-and-its-high-spending-international-buyers/

[8] https://foreignbuyerswatch.com/2016/05/23/foreign-buyers-in-portugal-french-british-chinese-buyers-in-love-with-portuguese-real-estate/