Notary fees are not the same in all French departments. Also, they are more expensive if you buy a second hand home than if you buy a new home. Several factors impact the French “frais de notaires” (notary fees). Let’s have a closer look at this expense, inherent to all real estate transactions in France.

Notary costs in France: 2-8% of the sale price

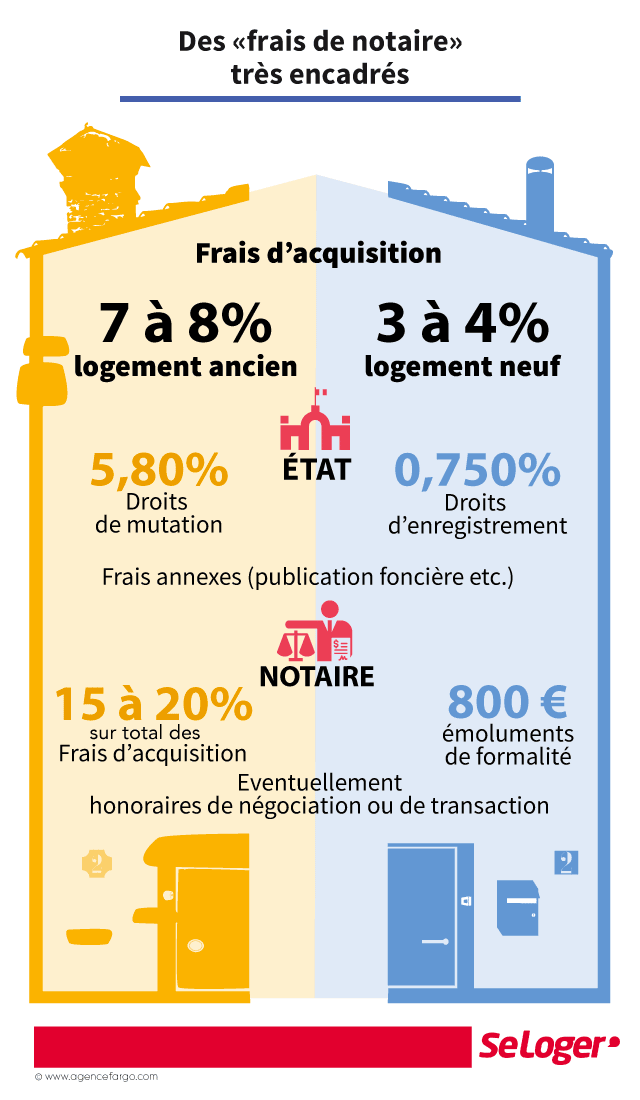

Acquisition fees, or “notary fees”, are not negotiable. How high are notary fees?

However, “the notary receives only a small percentage of these fees. Indeed the majority consists in taxes for the government, the department, the municipality. These taxes are grouped under the name of “transfer taxes” (5.80%) and “registry taxes”.

Out of these fees, the biggest tax is the departmental tax. This tax is not the same in all departments. In 2014, all departments increased their tax from 3.8 to 4.5%, except for Indre (36), Isère (38), Morbihan (56) and Mayotte (976). In addition, “there are some departments that have decided, since the beginning of this year, to increase their tax by 0.2%” says Elodie Fremont.

Who choses the notary? The buyer or the seller?

There is no law regarding the choice of the notary for a real estate transaction. While it is often the buyer who chooses the notary, the seller may also require that his notary be present for the transaction.

The presence of notaries of both parties does not entail additional costs, because the notary fees are framed by the law: they can not exceed 10% of the notary fees.

“Whether you take 1, 2, 3 or 5 notaries, it will not change anything,” says Elodie Fremont. “What you will pay to the notary(s), will be 1% of the transaction price, which will be divided according to the number of notaries”. “It is therefore better to opt for two notaries: one for the seller and one for the buyer.” “It is more reassuring for the seller as well as for the buyer to have a notary who takes their opinion into account” according to the Parisian notary.

Sources: SeLoger, PAP.fr, French-Property, JournalDuNet