Do French property prices grow too fast?

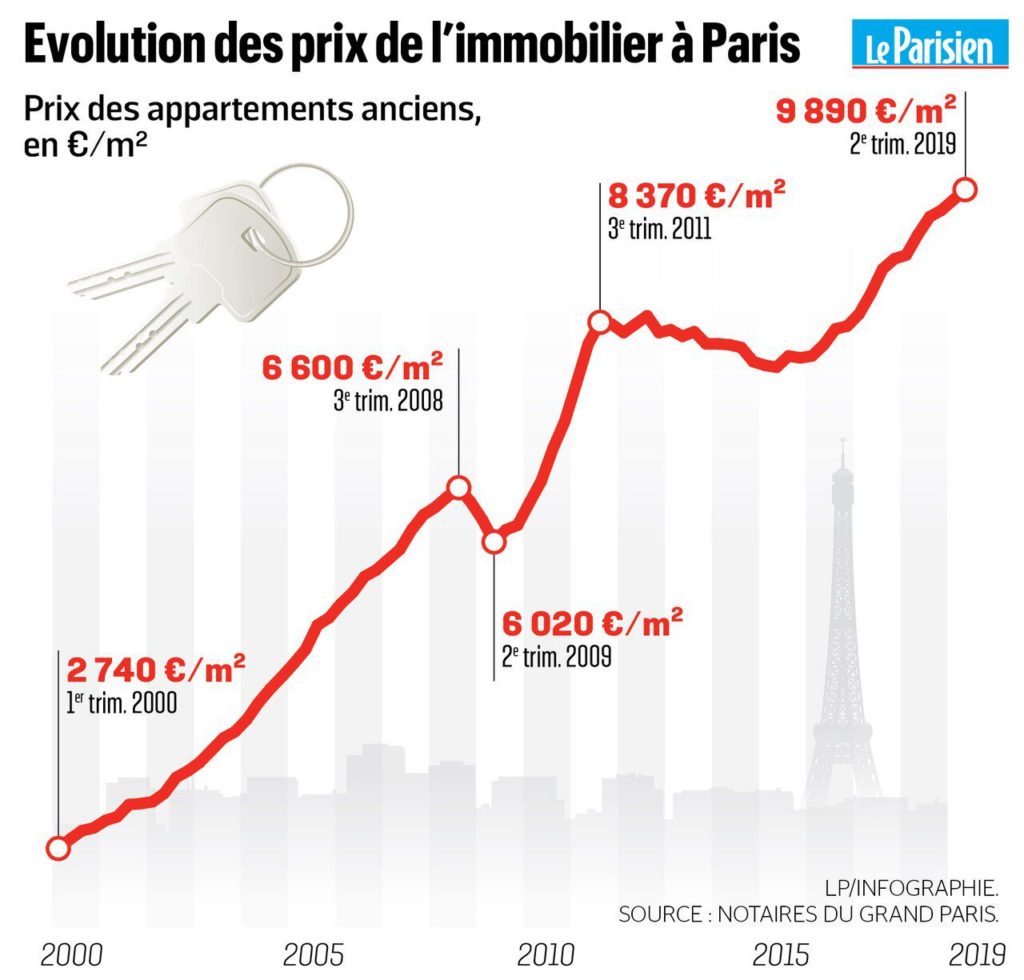

French real estate prices are growing fast. In its latest report of 48 pages, MeilleursAgents.com (acquired by Axel Springer) highlights this price increase. Clearly, house prices in Paris (in red) and in the top 10 cities (blue) accelerated in 2015.

Mortgage Rates explain it all

Mortgage rates have fallen drastically to reach an average 1.20%. As Younited Credit recalls, property mortgage rates were at 9% in the late 1980s and early 1990s. After the 2008-2009 crisis, rates increased slightly before decreasing towards the average 1.20% (for a 25 years mortgage).

At 9% interest rate, a € 200,000 mortgage over 25 years means a monthly cost of € 1,678. At 1.20%, this monthly payback to the bank becomes € 772 (PAP.fr). More recently, the interest rate we could observe in the summer of 2015 (2.60% for 25-year fixed-rate mortgage) meant € 907 (+17.5% compared to September 2019).

Therefore, interest rates and property prices work together. This decrease in interest rates increased the purchasing power of French people (x2 in 30 years).

A loan of € 200,000 contracted for 25 years represents €772 per month at a 1.20% interest rate, while it represents €1,678 per month if the interest rate is at 9%

So, is the property market going to crash?

No the French property market won’t crash. And the best explanation is given by GlobalPropertyGuide: the French mortgage market is mostly fixed rate, helping housing market stability. Indeed, should interest rates go up again, it wouldn’t create a crisis or the explosion of a bubble.

However, there is a risk of market correction. Indeed the 2008 financial crisis didn’t have a big impact on French property prices. Why did prices decrease by 35% in some major markets (UK, U.S., Spain) and leave France untouched? Thanks to the inflationary effect of low fix mortgage rates (Jacques Friggit, economist). Therefore a bank crisis in France would automatically create a major property market crash, as it happened in Greece or in Spain. Let’s hope we don’t get there.