Despite historically low mortgage rates, the middle class can no longer buy in Paris, where the average selling price is € 10,450 per m². To buy a 75 m² apartment in the capital, you must now earn 11 000 € net per month

Real estate prices in Paris at its highest: 10 451 € / m²

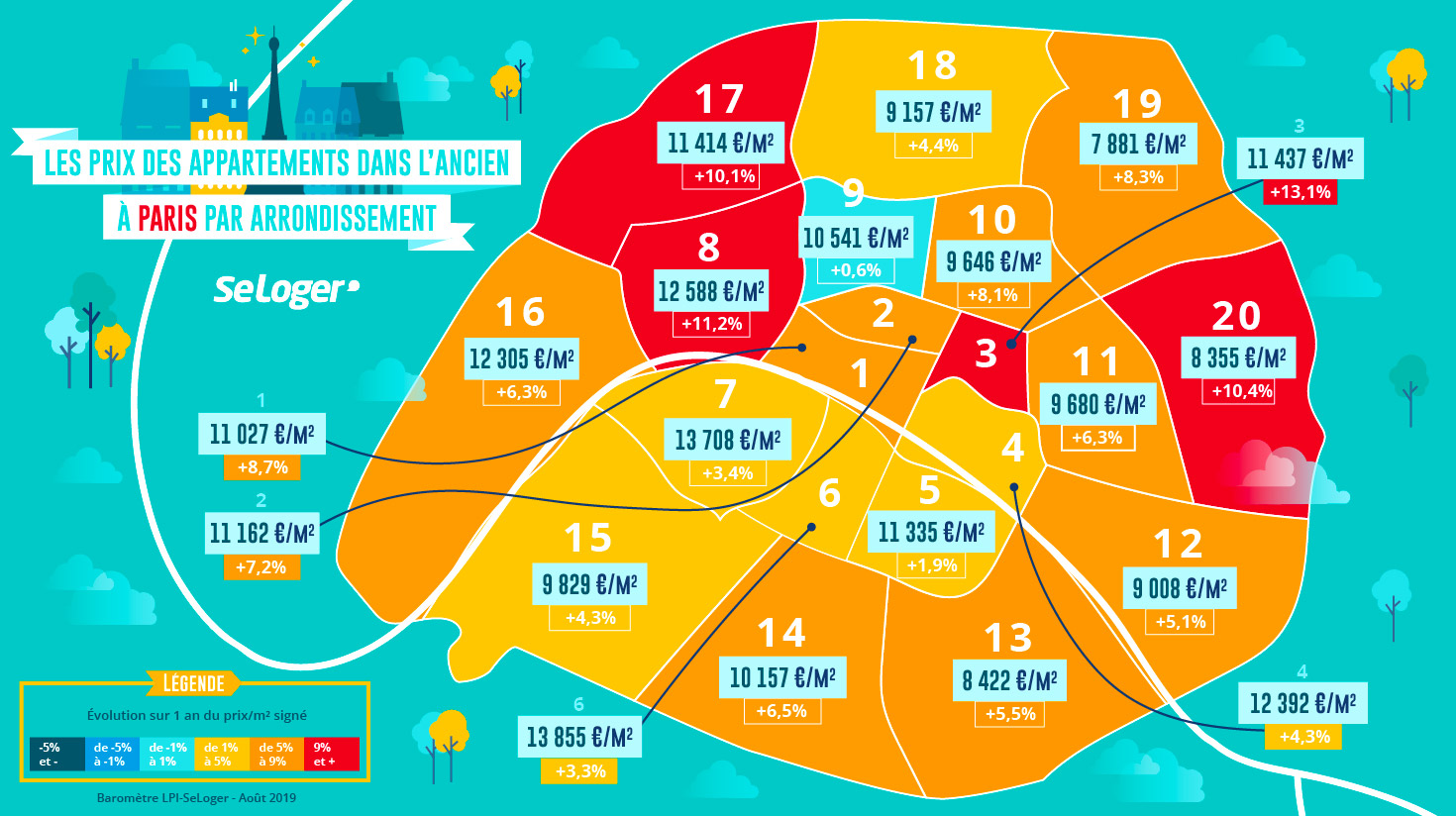

In September 2019, in the Parisian real estate market, SeLoger recorded sales prices around € 10,451 / m², which represents an annual increase of 6.3%. Worse, these high sales prices concern most of the city of lights’ territory. Prices exceed € 10,000 per square meter in 60% of the “arrondissements”. As a result, despite record-low interest rates, the middle-class can no longer buy in the French capital.

“In terms of real estate purchasing power, between 2012 and 2017 the increase in property prices in Paris was offset by the decrease in interest rates. But this is no longer the case since prices have passed the symbolic threshold of 9 000 € m² early 2018. Above 10 000 €, one can only buy 20.5 m² with average rates at 1, 35% over 20 years, compared to 24 m² in 2016, while mortgage rates were back then at 2.45% over 20 years “analyzes Sandrine Allonier, spokeswoman for the online broker VousFinancer.com.

Revenues required to buy a flat in Paris, 2009 to 2019

Looking back at interest rates and property prices together, here below are the average monthly mortgage payments one needs, for a 75 m² flat in Paris.

| 2009 | 2016 | 2019 | |

| Average mortgage interest rate | 4,30% | 2,45% | 1,35% |

| Monthly payment for a 75 m² flat | 2 808 € | 3 165 € | 3 667 € |

| Revenues required for a 75 m² flat | 8 424 € | 9 494 € | 11 002 € |

| Monthly payment for a 50 m² flat | 1 872 € | 2 110 € | 2 445 € |

| Revenues required for a 50 m² flat | 5 616 € | 6 330 € | 7 335 € |

Want to buy a 75 m² flat in Paris? You should earn 11 000 € net per month

Faced with such an increase in real estate prices, the Parisian property market becomes totally disconnected from revenues. As a result, the revenue required to buy in Paris has been steadily increasing since 2016. Today, to buy a 50 m² apartment in Paris, financed 100% via a loan over 20 years (with 10% downpayment to finance the expenses), one should earn at least 7,300 € net per month, and 11,000 € for 75 m² (to repay a loan of 771 000 € with monthly payments of € 3,667 over 20 years). In the French capital, the duration of loans is now longer (22 years and 8 months on average, an increase of 14 months) than in the rest of France. This shows the willingness of banks to offset rising prices.

Property investors represent 30% of buyers

First-time buyers can no longer stay afford to buy in Paris. So, they represent only 30% of buyers (against 43% in France), and buy with a very high downpayment (80 000 €). We also note that in Paris, the share of investors is twice higher (30%) than at the national level (15%). The purchase of the primary residence concerns only 68% of Parisian borrowers while 80% on average in France. A phenomenon that is starting to be noticed in the big cities where prices are high (Lyon and Bordeaux). “Even in a context of very attractive interest rates there is a real risk that certain types of buyers disappear from the property market, such as the modest households or the first-time buyers who can no longer afford to buy enough square meters”says Sandrine Allonier.

Profile of buyers in Paris

| All applicants | First-time buyers | Everyone except first-time buyers | |

|---|---|---|---|

| Average age | 37 years old | 33 years old | 40 years old |

| Share | 100 % | 28 % | 72 % |

| Yearly revenues | 80 000 € | 51 000 € | 90 500 € |

| Average downpayment | 112 000 € | 80 000 € | 124 000 € |

| Average loan | 295 000 € | 258 000 € | 309 000 € |

| Mortgage duration | 22,8 years | 23,5 years | 21,7 years |

“The share of investors among buyers increases: those who can not buy a sufficient surface in which to live decide to remain tenants of their primary residence, and make buy-to-let investments elsewhere”

Sandrine Allonier, spokesperson for the mortgage broker VousFinancer.com

Source: this article was published on SeLoger.com in French language, on 6 September 2019